Business Valuation Gross Revenue Multiplier

Sellers Discretionary Earnings SDE Multiple Formula. EVR is one of several fundamental indicators that.

Saas Valuations How To Value Your Software Company In 2021

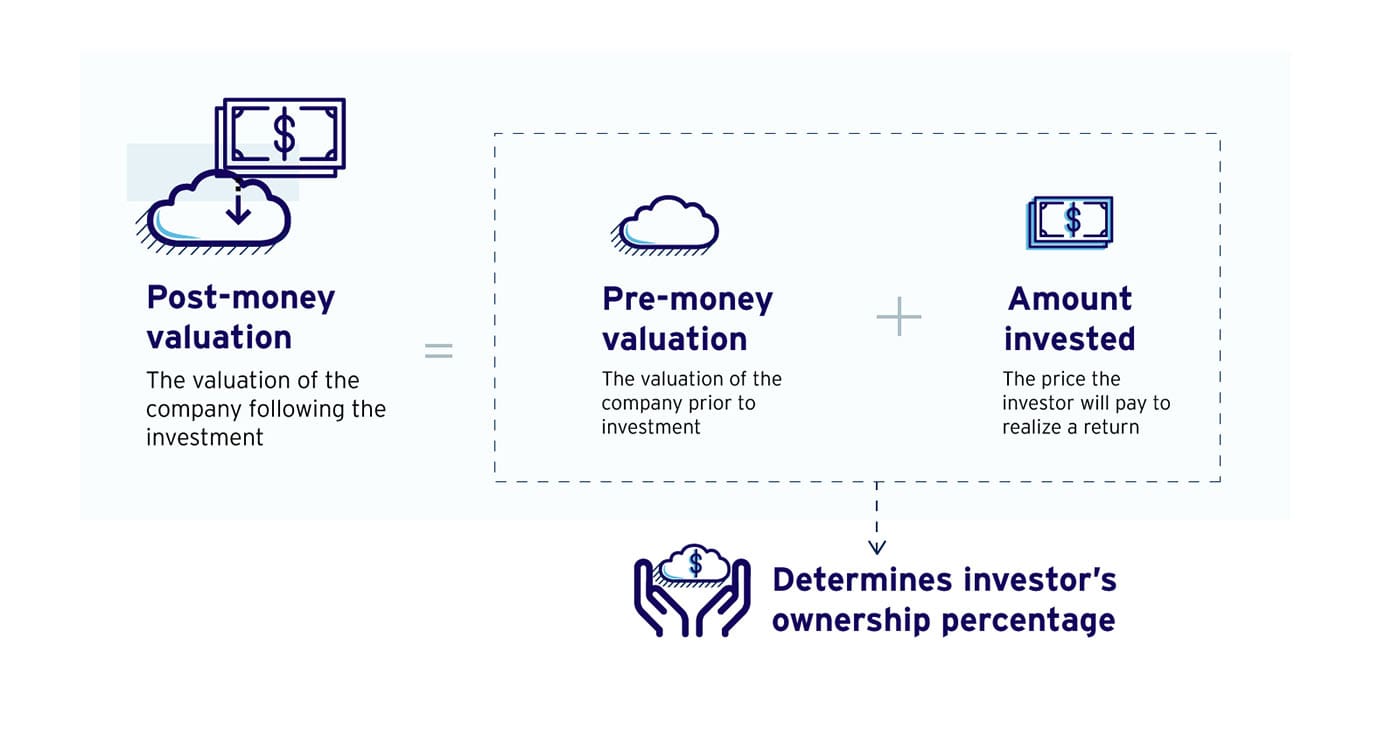

Annons See the value of a company before and after a round of funding.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

Business valuation gross revenue multiplier. Revenue multiples for eCommerce businesses tend to be in the range of 07-3x. Buyers guided by appraisers and business valuation experts use rules of thumb to value businesses based on multiples of business earnings. Whether you are thinking of possibly selling your business and want to know how to maximize its value or if you just want to know how much your business is worth its important to understand that many different factors go into business valuations and that these factors vary significantly.

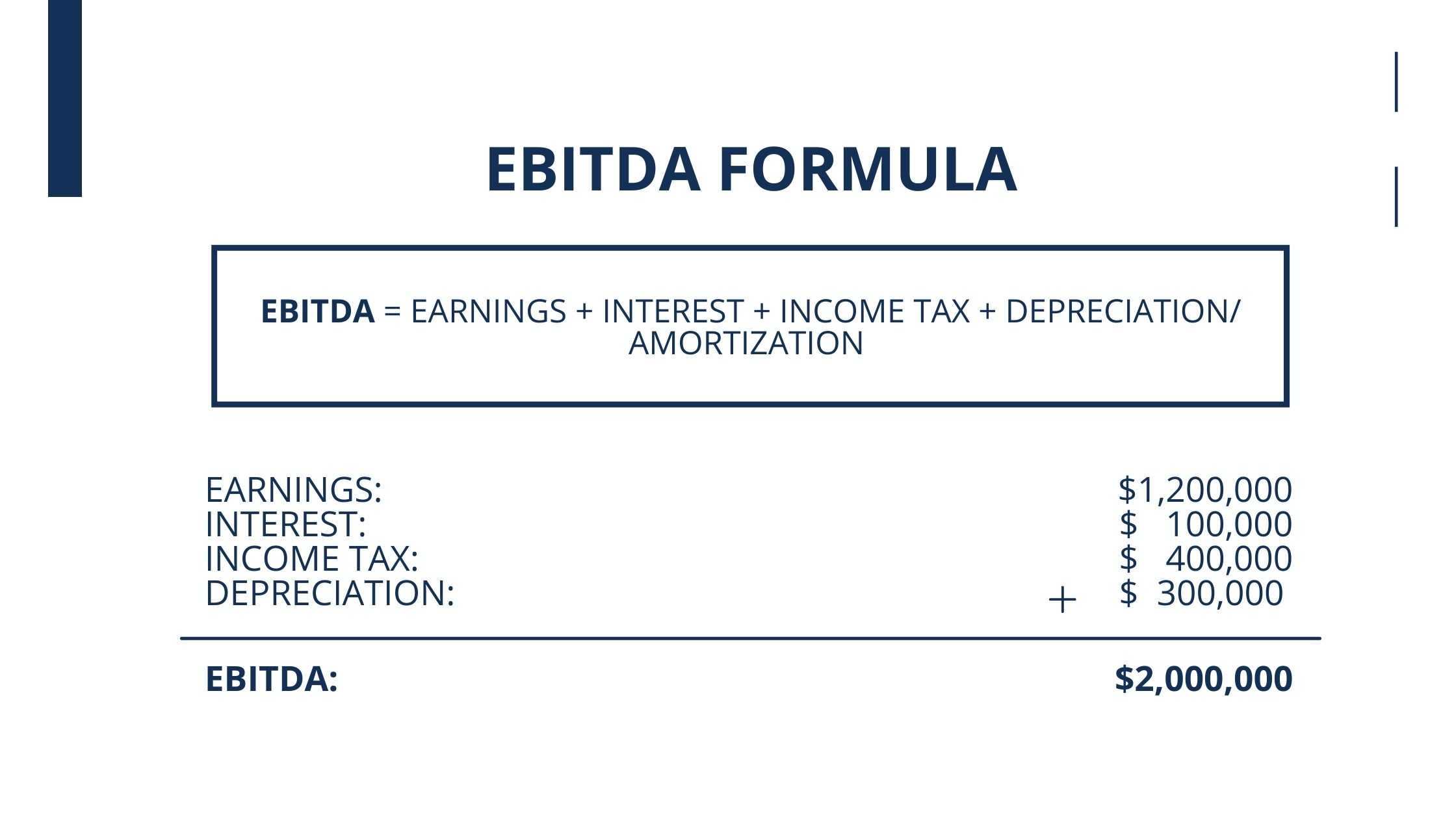

For example if your companys adjusted net profit is 100000 per year and you use a multiple like 4 then the value of the business will be calculated as 4 x 100000 400000. In profit multiplier the value of the business is calculated by multiplying its profit. We provide enterprise value multiples based on trailing Revenue EBITDA EBIT Total Assets and Tangible Assets data as reported.

The average multiplier for all businesses with a value below one million dollars is between 23 and 27 depending on the database source. 98 rader Industry specific multiples are the techniques that demonstrate what business is worth. These can be dependent on.

Two commonly used methods of quickly approximating value are. Discover why PitchBook is the only tool you need for your next business valuation. Competition gross margins addressable market etc All revenue is not created equal and revenue multiple captures a complex balance of a companys 1 growth prospects 2 profitability and 3 long-term risk profile.

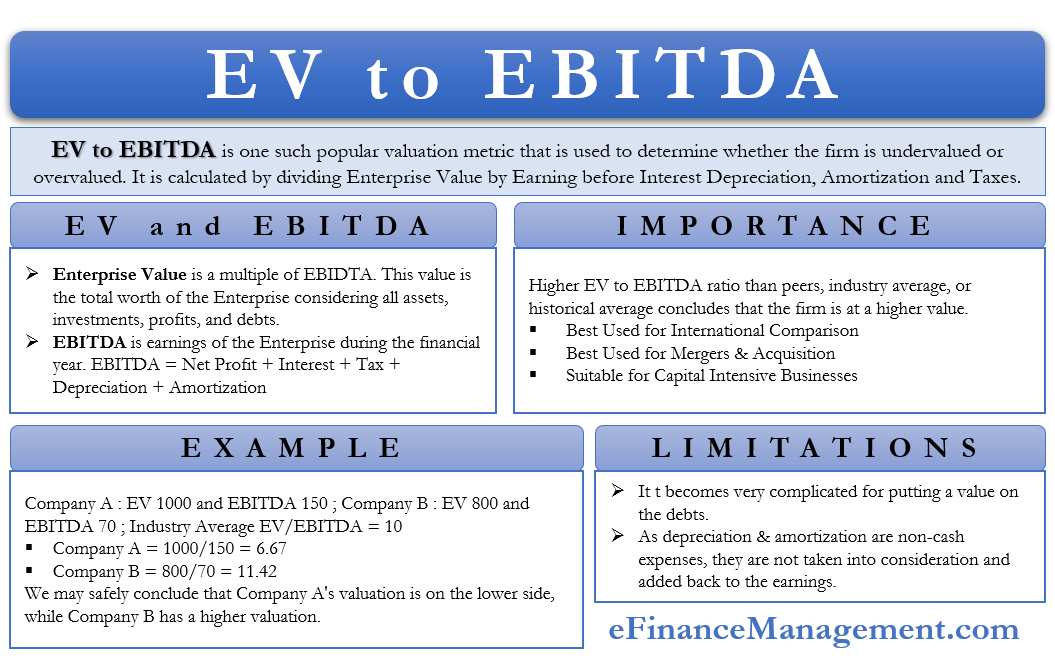

Customer profile and purchasing patterns. The enterprise value-to-revenue multiple EVR is a measure of the value of a stock that compares a companys enterprise value to its revenue. Business Valuation Annual sales x industry multiple.

This multiplier is applied or multiplied against what is known as Owners Discretionary Earnings. SDE Valuation Annual profits owners salary x industry multiple. Business Valuation Multiples by Industry Selling Tips.

There are some national standards depending on industry type and business size. Discover why PitchBook is the only tool you need for your next business valuation. Multiple of revenue or revenue multiple is a ratio that is used to measure a companys value based on its net sales or gross revenue.

Annons See the value of a company before and after a round of funding. Note that the valuation multiple is the reciprocal of the Capitalization rate. ECommerce businesses are generally valued on a revenue multiple to reflect high growth potential and recurring or repeat revenue patterns.

An alternate version of this method examines your current earnings makes projections about your future earnings and uses a multiple to arrive at a business valuation. Valuation Multiples by Industry. The table below summarises eVals current month-end calculations of trailing industry enterprise value EV multiples for US listed firms based on trailing 12-month financial data.

Bizbuysell says nationally the average business sells for around 06 times its annual revenue. Revenue multiple can be useful when comparing companies that have different levels of profits but similar business characteristics ie. See multiples and ratios.

Valuation multiple is a multiplier used to convert a single-point business economic benefit into the business value. Annual Sales Multiple Formula. However some financial experts say that this valuation method is not so reliable as it just measures the revenue of a company which some consider a poor indicator of value.

The typical economic benefit used in business valuation is a measure of business earnings such as the sellers discretionary cash flow SDCF. 1 applying a multiple to the discretionary earnings of the business and 2 applying a percentage to the annual gross revenue of the business. It is used in the valuation of any given business.

If your industry standard multiple is five times sales and your sales revenue last year was 80000 then your business would be valued at 400000 using this method. See multiples and ratios. When to Consider Using a Business Valuation Expert.

Saas Valuations How To Value Your Software Company In 2021

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Ebitda Margins What Every Small Company Owner Needs To Know

Ev To Ebitda Definition Formula Interpretation Better Than Pe Example

Discounted Cash Flow Analysis Street Of Walls

The Right Role For Multiples In Valuation Mckinsey

Saas Valuations How To Value Your Software Company In 2021

Saas Valuations How To Value Your Software Company In 2021

The Right Role For Multiples In Valuation Mckinsey

Business Valuation How Investors Determine The Value Of Your Business Entrepreneur S Toolkit

The Income Approach To Real Estate Valuation

The Impact Of Gross Margin On Saas Valuations Software Equity Group

Discounted Cash Flow Analysis Street Of Walls

The Impact Of Gross Margin On Saas Valuations Software Equity Group

Saas Valuations How To Value Your Software Company In 2021

:max_bytes(150000):strip_icc()/dotdash_Final_Multiple_Nov_2020-01-5cc7fb72038d42a7a9ea850d8b4c2208.jpg)

/dotdash_Final_Multiple_Nov_2020-01-5cc7fb72038d42a7a9ea850d8b4c2208.jpg)

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

Posting Komentar untuk "Business Valuation Gross Revenue Multiplier"