Business Use Of Home Simplified Method Worksheet 2020

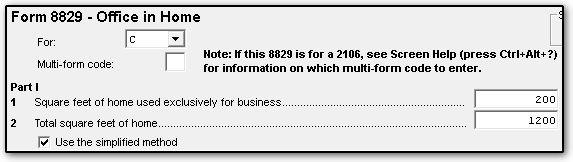

To elect the simplified method open the 8829 screen and select the applicable form or schedule in the For drop list. The maximum space is 300 square feet for a maximum deduction of 1500.

How To Claim The Home Office Tax Deduction As A Full Time Rver Or Digital Nomad Nuventure Cpa Llc

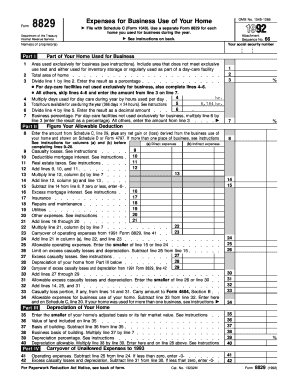

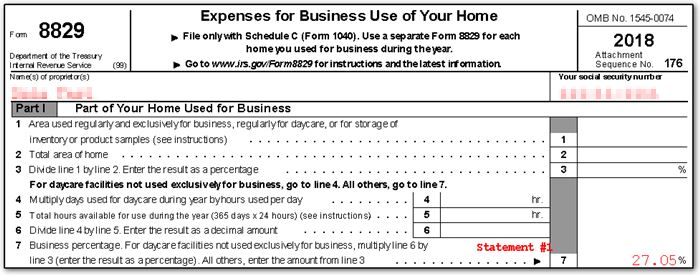

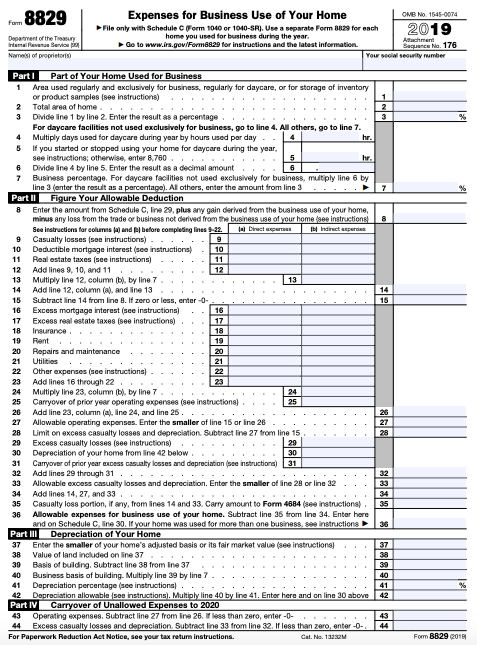

Form 8829 Business Use of Home.

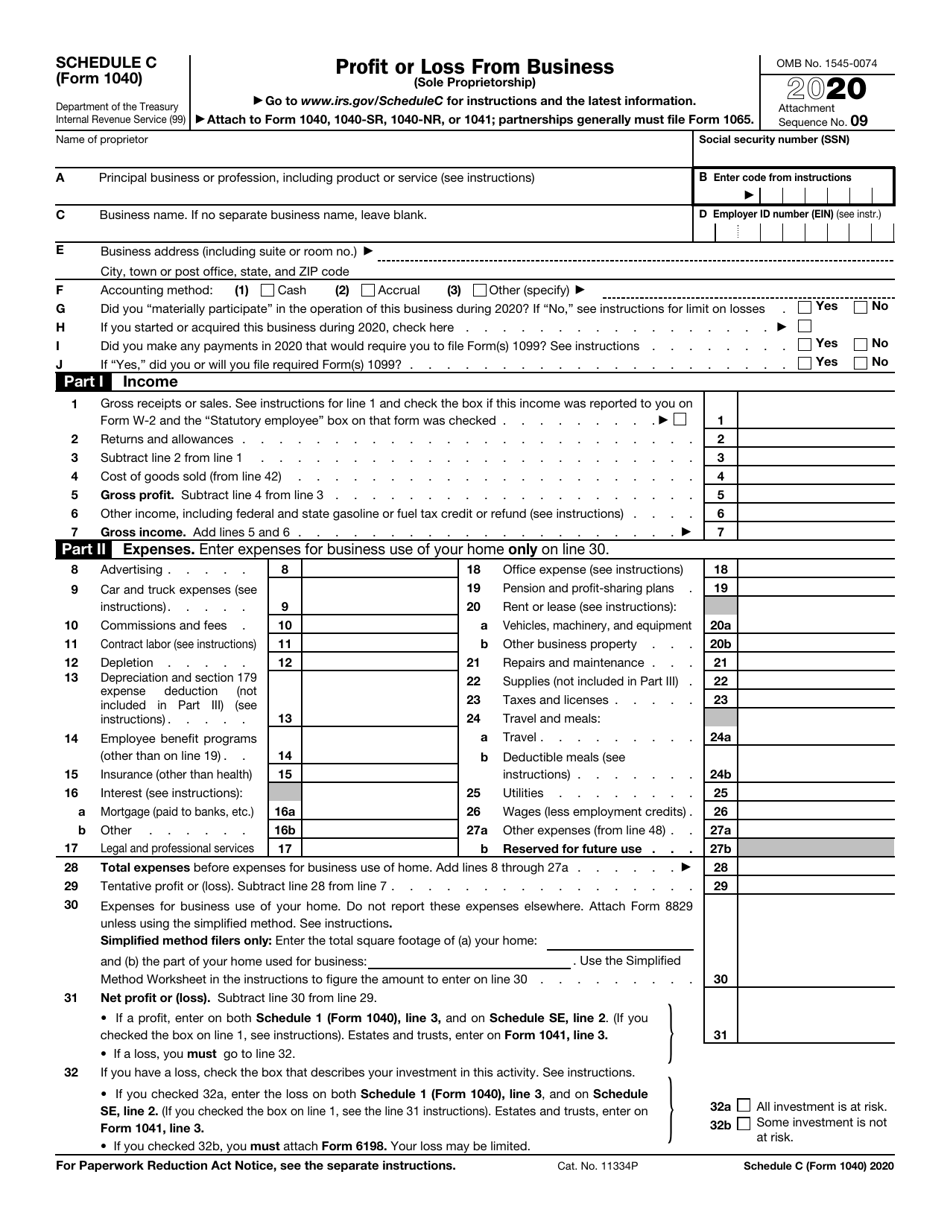

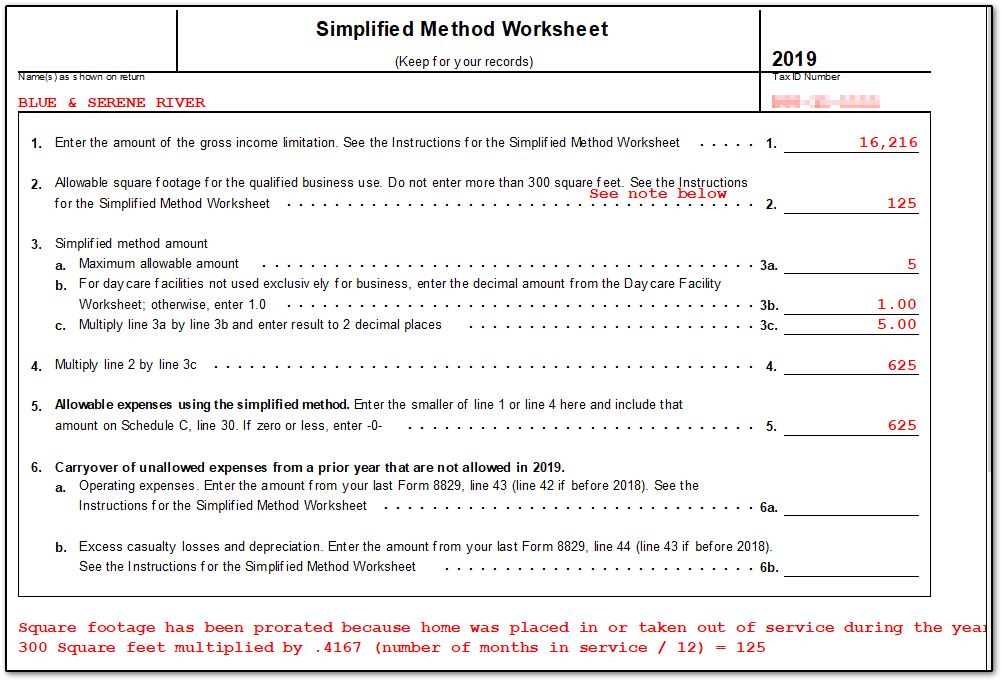

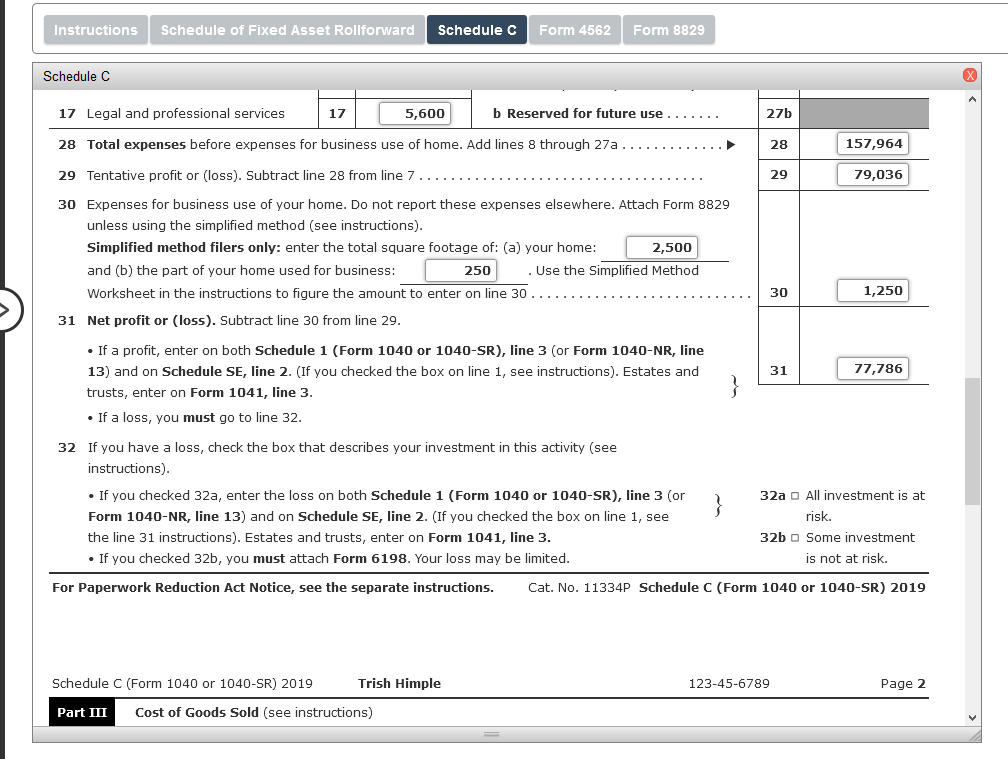

Business use of home simplified method worksheet 2020. The Simplified Calculation Method. The IRS allows you to make a simple calculation for small office spaces. If you are filing Schedule C Form 1040 to report a business use of your home in your trade or business and you are using the simplified method to figure the deduction use the Simplified Method Worksheet and the Daycare Facility Worksheet in your Instructions for Schedule C for that business use.

If you dont use the work area of your home exclusively for daycare you must reduce the prescribed rate which is a maximum of 5square foot before figuring your deduction. To calculate the home office deduction using the simplified method you need the following information. The maximum deduction is 1500.

If you use the simplified method for one year and use the regular method for any subsequent year you must calculate the depreciation deduction for the subsequent year using the appropriate optional depreciation table. Find the square footage of your home office space and multiply that by 5 a square foot. The square footage of the area of your home that you use exclusively and regularly for business.

Use the Simplified Method Worksheet in the instructions for Schedule C for your daycare business. Actual business expenses that are not tied to the home office such as marketing and advertising or supplies and equipment are still deductible. The aim of this option is to reduce paperwork and recordkeeping burdens on small businesses.

The information will go on IRS Form 8829 which feeds into Schedule C. The deduction may not exceed business net income gross income derived from the qualified business use of the home minus business deductions. Standard 5 per square foot used to.

Deduction for home office use of a portion of a residence allowed only if that portion is exclusively used on a regular basis for business purposes. Under the simplified method the standard home office deduction amount is 5 per square foot up to 300 square feet of the area used regularly and exclusively for business. In addition to the home office space deduction you may also claim mortgage interest and real estate taxes on Schedule A.

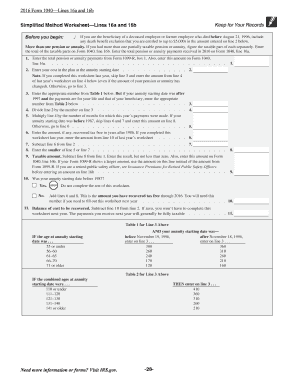

While the simplified method can be useful for some self-employed individuals the deduction is capped at 1500 each year. Standard 5 per square foot used to. If the taxable amount isnt calculated in Box 2 the Simplified Method must be used.

Enter a Multi-Form code if applicable. The IRS allows a business owner who is claiming the home office deduction to calculate the deductions size using one of two methods. Click here for more information about creating a Schedule C in TaxSlayer Pro.

For years after January 2 2013 taxpayers may elect to use a simplified method instead of actual expenses when figuring the deduction for business use of their home. Most of the information here will change every year except for the business percentage and the section related to depreciation. Simplified Method Home Office Tax Deduction.

If you use TaxSlayers simplified method worksheet enter a note with the taxpayers annuity start date age at the start date and amounts previously recovered to help next years preparer. It is capped at 1500 a year based on 5 a square foot for up to 300 square feet. You can claim the business proportion of these bills by working out the actual costs.

You can only use simplified expenses if you work for 25 hours or more a month from home. Deduction for home office use of a portion of a residence allowed only if that portion is exclusively used on a regular basis for business purposes. The actual expense method or the simplified method.

Standard numbering on a Form 1099-R. In response the Canada Revenue Agency CRA has introduced a new temporary flat rate method to simplify claiming the deduction for home office expenses for the 2020 tax year. To claim the expense on a Schedule C first create the Schedule C that relates to the business.

The simplified deduction is optional. Simplified Option Regular Method. Then within the Schedule C from the Schedule C - Edit Menu select.

For years after January 2 2013 taxpayers may elect to use a simplified method instead of actual expenses when figuring the deduction for business use of their home. To elect the simplified method open the 8829 screen and select the applicable form or schedule in the For drop list. This is true regardless of whether you used an optional depreciation table for the first year the property was used in business.

Otherwise youll have to use the regular method. The Simplified Method Worksheet may be used as an alternative. Home Office Deduction Use this worksheet to figure out your full home office deduction.

As an employee you may be able to claim a deduction for home office expenses work-space-in-the-home expenses office supplies and certain phone expenses. Allowable square footage of home use for business not to exceed 300 square feet Percentage of home used for business. There are some limitations to this method.

Enter a Multi-Form code if applicable. When you elect to use the simplified method for your client you cannot deduct any depreciation or section 179 expense for the space being used as the home office. Allowable square footage of home use for business not to exceed 300 square feet Percentage of home used for business.

This area cannot exceed 300 square feet. Hours of business use.

Https Www Efile Com Tax Service Pdf 0015 Pdf

How To Deduct Your Home Office On Your Taxes Forbes Advisor

Home Office Deduction Worksheet Bastian Accounting For Photographers

8829 Simplified Method Worksheet Fill Out And Sign Printable Pdf Template Signnow

Home Office Deduction Worksheet Bastian Accounting For Photographers

Simplified Home Office Deduction When Does It Benefit Taxpayers

11781 Form 8829 Office In Home

8829 Simplified Method Schedulec Schedulef

8829 Simplified Method Schedulec Schedulef

Irs Form 1040 Schedule C Download Fillable Pdf Or Fill Online Profit Or Loss From Business Sole Proprietorship 2020 Templateroller

Simplified Home Office Deduction

8829 Simplified Method Schedulec Schedulef

Https Apps Irs Gov App Vita Content Globalmedia 1099r Pension And Annuity Income 4012 Pdf

8829 Simplified Method Schedulec Schedulef

23 Printable Worksheet Template Forms Fillable Samples In Pdf Word To Download Pdffiller

Simplified Home Office Deduction When Does It Benefit Taxpayers

Instructions Comprehensive Problem 8 1 Trish Himple Chegg Com

Posting Komentar untuk "Business Use Of Home Simplified Method Worksheet 2020"